Towards transforming agriculture and forest investments in Lao PDR

Lao PDR endorsed the ASEAN Guidelines for Responsible Investments in Food, Agriculture and Forestry (ASEAN RAI) in 2018, setting off a wave of transformation in agriculture and forest investments. Government policies and market forces have evolved rapidly in the years since, with investors prioritizing sustainability, inclusiveness, renewable energy and responsible practices.

To understand this evolving landscape, RECOFTC and LEI conducted a survey among 37 investors from the agriculture and forestry sectors working across the country. We looked at how and why investors have been improving their investments, the challenges they face and the support they need to foster more inclusive, eco-friendly and profitable practices.

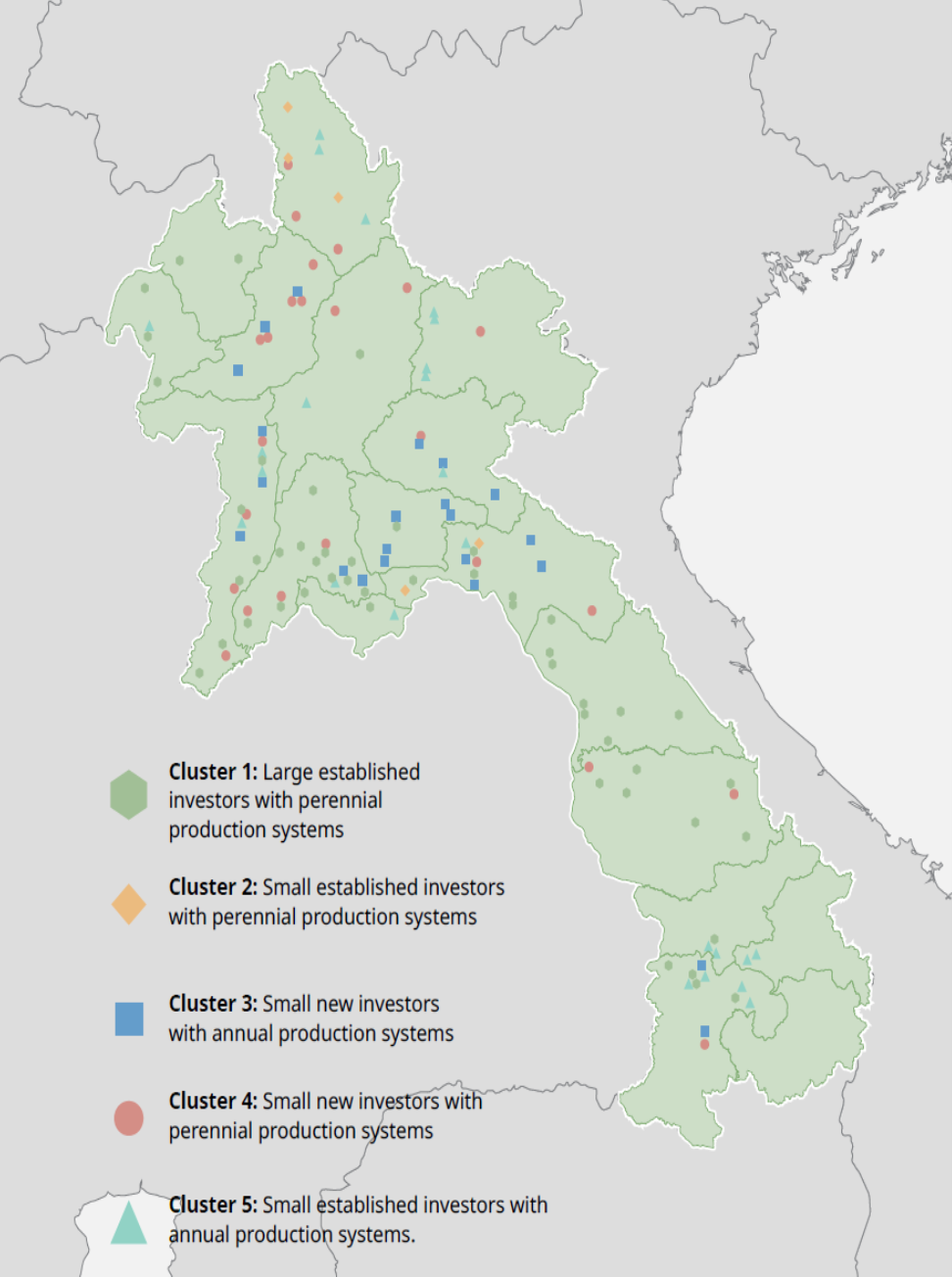

We divided the investors we surveyed into five clusters.

Our analyses focused on four key areas – good governance, environmental stewardship, local development and benefits to wider society. They provide a snapshot of a country in transition, where investors are not only seeking profit but also striving for a positive environmental and social legacy.

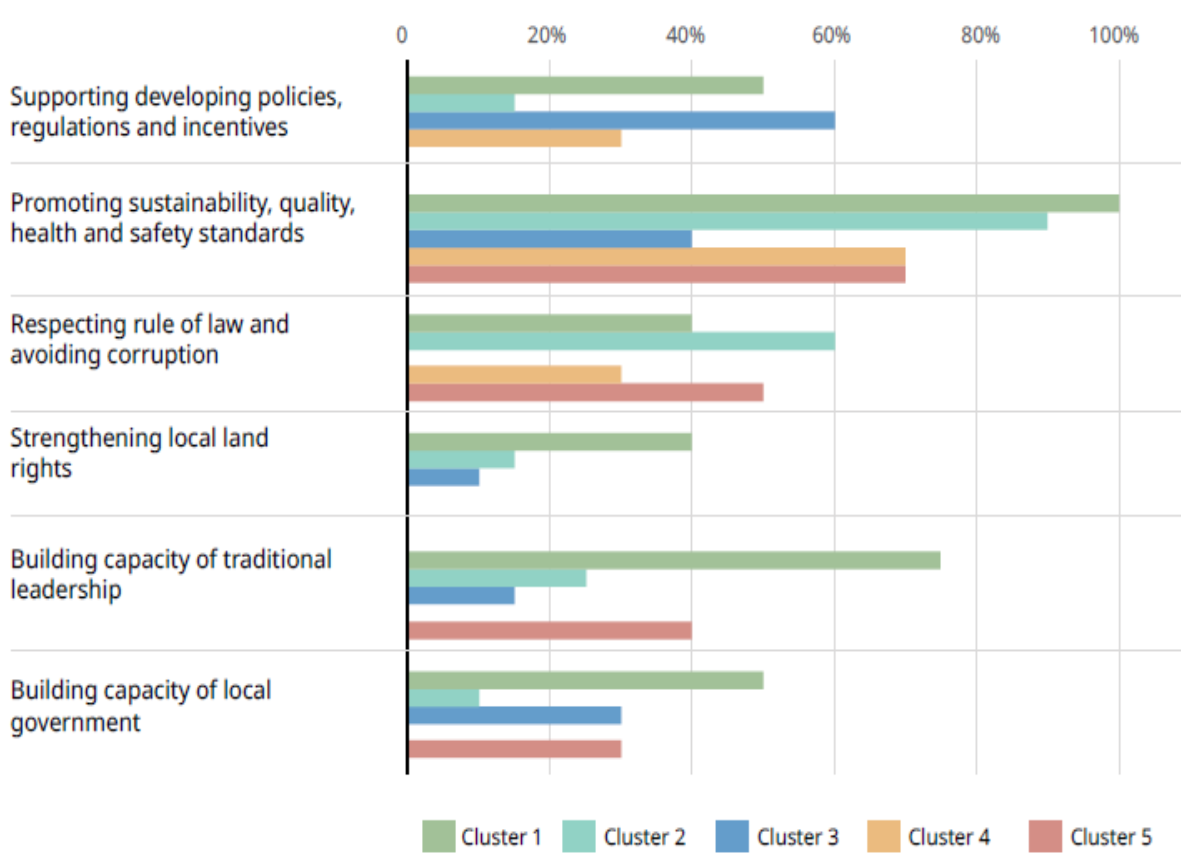

Good governance

An overwhelming number of investors we surveyed, 75 percent, noted that while they are committed to good governance and standards, they face significant challenges in adhering to regulations, largely due to complexities, associated costs and frequently changing procedures.

Investors say they want to improve awareness, capacities, compliance with regulations, monitoring, information management, and access to markets and finance. However, they face constraints. A lack of human and financial capacities, limited cash flow, difficulty in understanding rules and regulations, and challenges in accessing soft loans are some of the main internal constraints. External constraints include high transaction costs, limited support from local authorities, inadequate monitoring of illegal harvesting, difficulty accessing relevant policies and data, and insufficient external support for forming farmers' groups.

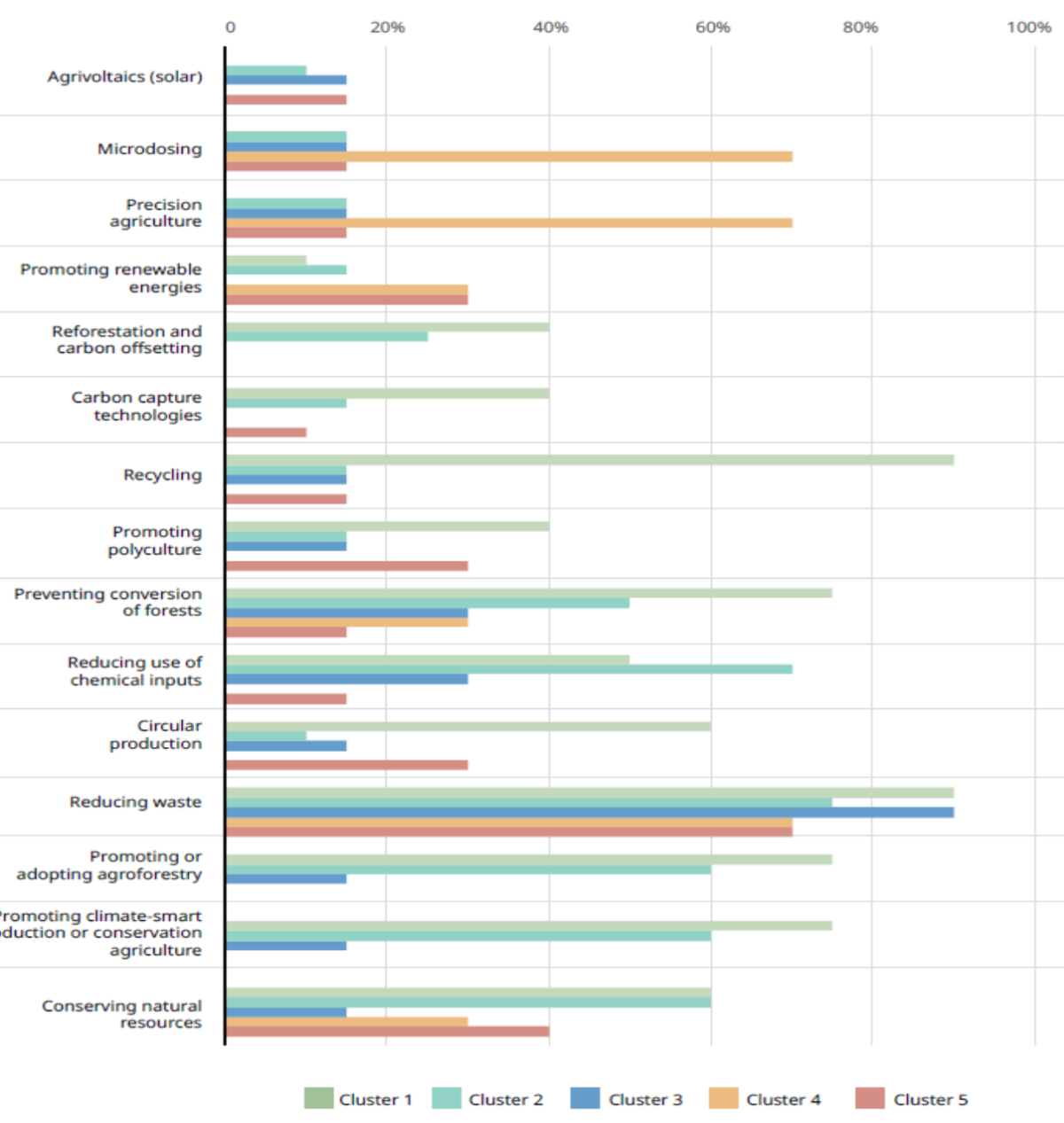

Environmental stewardship

While investors prioritize waste reduction and environmental protection, the adoption of advance practices like climate-smart production and carbon capture is limited. High investment costs, skills gaps and insufficient technical support pose obstacles. However, the trend towards greener practices and renewable energy initiatives, which are seen as key investment opportunities, is also very clear.

Investors plan to minimize chemical usage, conduct environmental and social impact assessments and champion renewable energy initiatives. Yet, internal and external hurdles loom large, with high investment costs, skills gaps among workers and limited government support posing tough challenges.

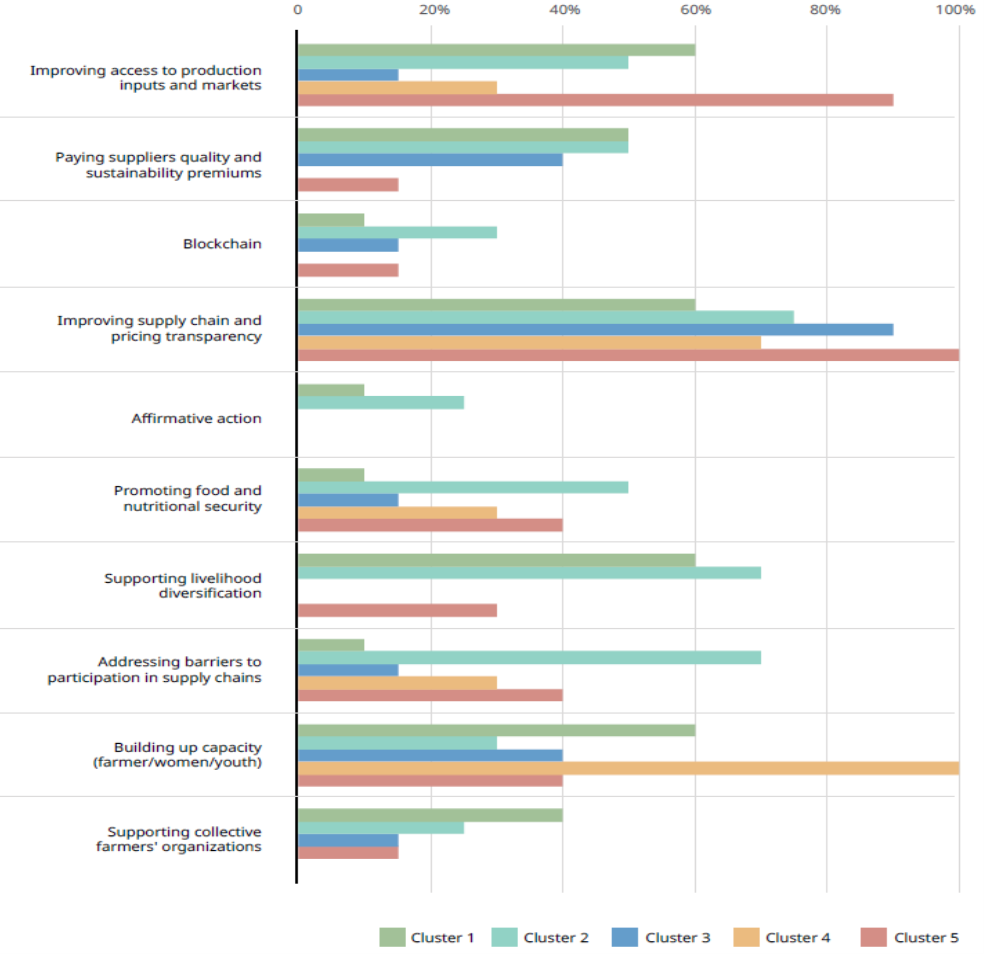

Local development

Investors are working to enhance local development by improving supply chain transparency, supporting smallholders’ access to production inputs, building capacities among local communities and adhering to fair trade standards. Despite these efforts, financial constraints, unclear guidelines and limited support hinder further progress, particularly in areas like traceability and local group formation.

The drive for progress largely revolves around enhancing infrastructure, fostering collective efforts and encouraging diverse livelihoods. Yet, this is hampered by internal constraints such as limited financial resources and expansion opportunities, coupled with external challenges such as unclear guidelines on local development promotion, tight local government budgets and restricted access to soft loans.

Benefits to wider society

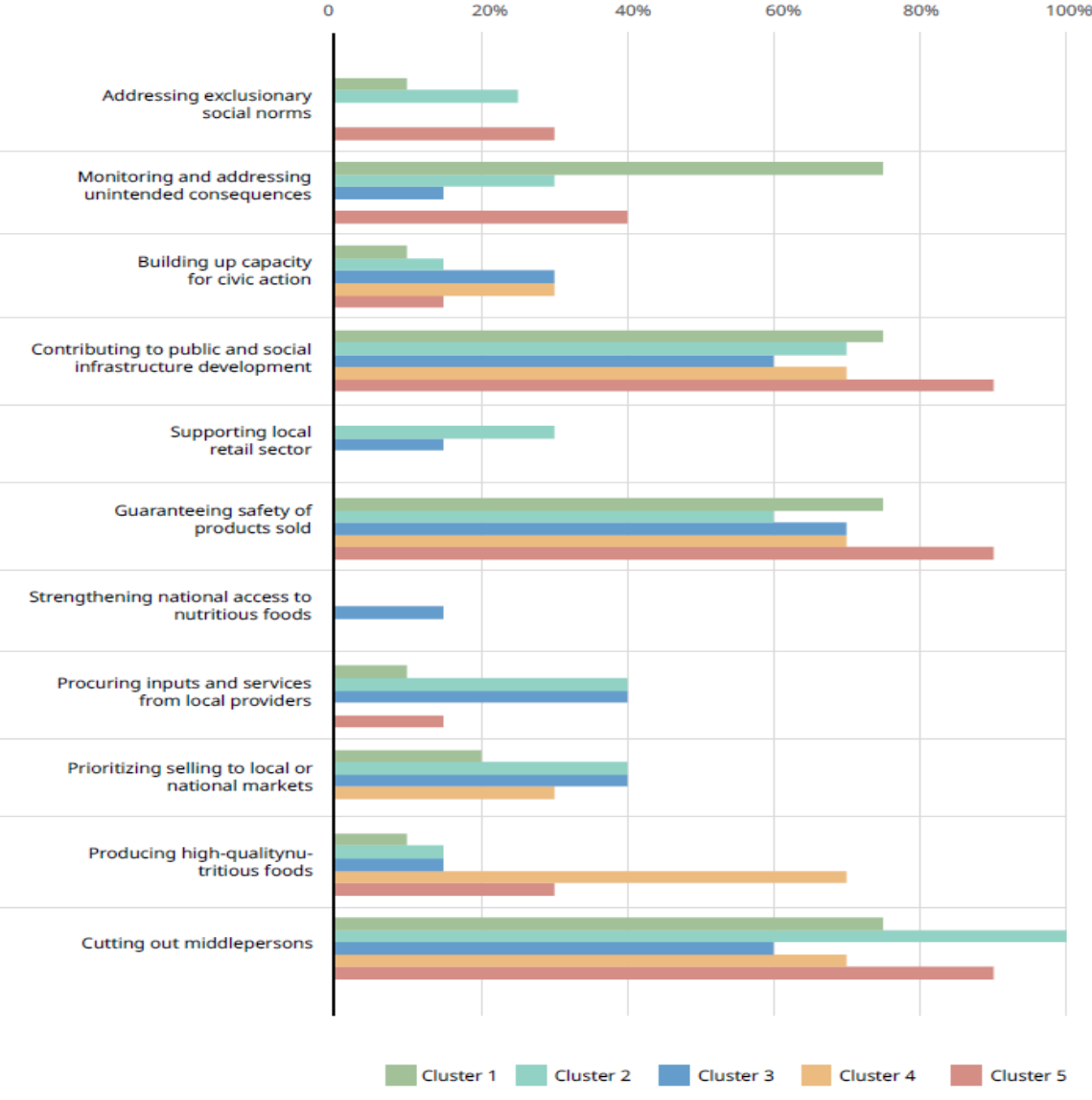

The vast majority of investors are streamlining their supply chains, encouraging farmers to sell directly to nearby factories to reduce transportation costs and unnecessary transactions. A significant majority prioritize product safety and adherence to international standards. Likewise, an equal proportion of them contribute to public and social infrastructure development, whether by supporting school construction, meeting rooms or road projects.

However, there is ample room for improvement in other social initiatives. For instance, only about a third of investors focus on producing high-quality nutritious foods, selling to local or national markets, sourcing inputs and services locally, monitoring and addressing unintended consequences of operations or challenging exclusionary social norms. Furthermore, only about 20 percent of the investors we spoke to support the local retail sector or provide capacity-building for civic action.

Looking ahead, they want to diversify employment and income-generating activities, enhance technical skills and knowledge, and support cultural endeavors. Some of them also said they want to raise minimum wages. However, internal challenges such as raising awareness and gaining commitment from farmers remain. External obstacles include inadequate monitoring of side-selling and theft of resources, along with limited understanding of contract farming among local communities.

Targeted support for sustainable investments

We divided the investors we surveyed into five clusters – Cluster 1: Large established international investors with perennial crops, Cluster 2: Small established investors with perennial crops, Cluster 3: Small new investors with annual production systems, Cluster 4: Small new investors with perennial crops, and Cluster 5: Small established investors with annual production systems. Each investor cluster has distinct needs that can be addressed with targeted support:

Cluster 1 investors prioritize more transparency and better monitoring of collection permits and illegal trade. They seek stronger enforcement of laws and policies, as well as simpler and clearer instructions and dissemination of updated investment laws and regulations.

For Cluster 2 investors, possible reductions to the value-added tax and other taxes and fees that are higher than those in neighboring countries are a major priority. They also desire a simplification of the process for environmental and social impact assessments, reduced related costs, and improved procedures and instructions for land leases.

Investors in Cluster 3 seek greater access to finance, support for small and medium-sized enterprises to recover from COVID-19 losses, and reduced costs for environmental inspections. They also advocate for the reduction of transportation taxes and fees between provinces.

Cluster 4 investors call for bureaucratic support, clarity and transparency, and improved access to soft loans. They also seek quicker processing of documentation and timely support from authorities, particularly with export processes. Additionally, some investors expressed a need for support with improved production techniques.

For Cluster 5 investors, fiscal incentives are particularly important. They also highlight the need for access to credit, including low-interest loans. Regarding bureaucratic support, they requested that the government disseminate information, coordinate and support investors, and monitor the illegal harvesting.

An evolving landscape towards sustainability

The steps currently being taken in Lao PDR’s agriculture and forestry sectors align with broader global movements toward sustainability and responsible investment practices.

Across all the investor clusters we surveyed, there is recognition of the need for better regulatory clarity, fiscal incentives, improved access to finance and support for technical aspects of production and export. These would go a long way in strengthening the notable strides industries are making in adopting good governance, environmental stewardship and local development initiatives.

Varied progress across the different clusters underscores the need for targeted support, and the evolving investment landscape reflects a growing commitment to balancing economic growth with environmental sustainability and social responsibility.

The complete results of the survey are available in ‘Land- and forest-based investments in

Lao PDR: Practices and perspectives’.

###

Robin Claudio aus der Beek is project coordinator of Transformative Land Investment (TLI) project at RECOFTC.

The TLI project, supported by SDC under the Global Food Security program, aims to make land-based investments more economically, socially and environmentally advantageous by integrating inclusive development, sustainable food systems and agroecology principles into their practices, policies and business models.

For more information, visit the TLI project website.

RECOFTC’s work is made possible with the support of the Swiss Agency for Development and Cooperation and the Government of Sweden.