Financing FLR: What to consider for a sustainable investment

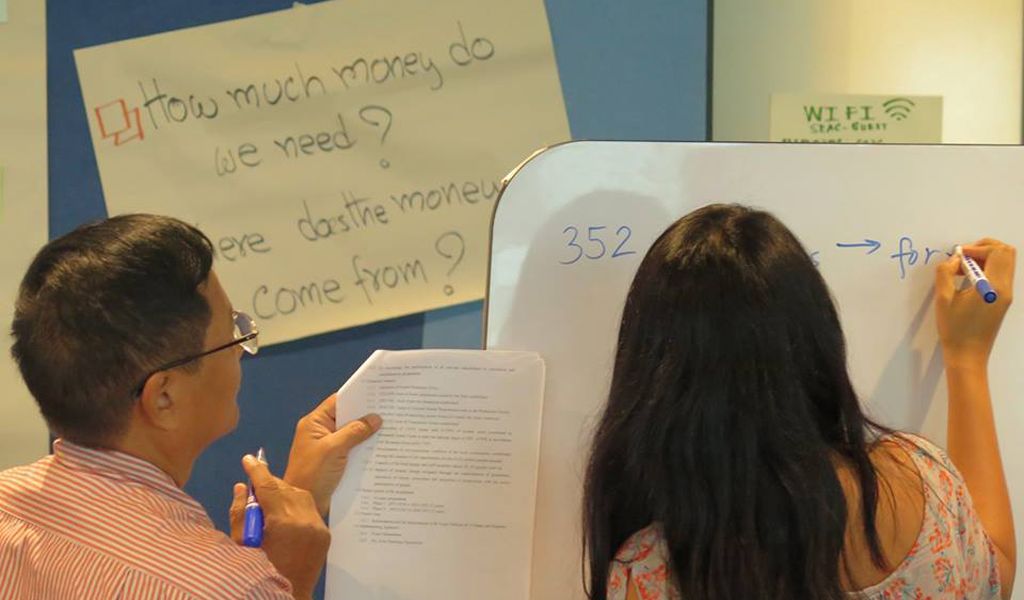

How can we ensure that a participatory process is effectively implemented to engage local people and create sustainable investments for financing Forest Landscape Restoration (FLR)? We know that it will potentially achieve the long term ecological, social and economic benefits that FLR offers, but we still haven’t found a way! To further unpack this puzzle, RECOFTC, along with FAO and IUCN, organised a regional dialogue for stakeholders. The event aimed to provide a platform for the participants to get to know each other, discuss challenges, and contemplate opportunities for financing FLR. Having this event therefore allowed stakeholders to better understand their roles in terms of FLR and come closer to ensuring a participatory process in investing in FLR!

The questions discussed were relevant to achieving our goal. For example, what’s the most important thing for a sustainable investment by private sector? We would argue that it is about reducing potential risks that arise from the prominent issue in natural resource management - land tenure. This means a participatory approach that engages key stakeholders, especially local people, is fundamental.

For government officials involved in FLR, providing consistent landscape information and creating a supportive regulatory environment is imperative for a sustainable investment. Most importantly, these two principles should be respected and confirmed by all the stakeholders involved in FLR, especially local people. If care is taken to ensure the participation of local people, then this may led to a higher return of investment, particularly in areas where land tenure is concerned. As such, investors need to be assured that their investment does not impinge on unresolved land issues or further conflict over tenure rights. Hence, such information and a supportive regulatory environment will allow the private sector to assess the scale of FLR opportunities in the region and the potential socio-economic benefits (e.g. returns of investment).

Furthermore, in forging partnerships with private sector actors, government officials would need to target specific, and appropriate, financial instruments. This is primarily because private sector actors do not conduct business using the same model. For instance, plantation companies (e.g. New Forests), commercial banks (e.g. Credit Suisse) and finance institute (e.g. International Finance Corporation) all have different objectives and requirements. Hence, government officials need to consider aspects such as the purpose of FLR (e.g. wood production, local livelihood development through agroforestry), duration of the project and amount of investment required.

Regarding the first question, this regional dialogue has provided us at RECOFTC a chance to better understand the areas that need to be improved to further promote sustainable financing of FLR. For example, this dialogue showed us that further conversation is needed between sectors to overcome the language barrier that is inherently present across sectors. Yet we were able to help government officials realize the importance of collecting specific and reliable information to reduce risk. This goes a long way in targeting the appropriate financial instruments for FLR initiatives. Most importantly, however, the design of FLR initiatives must consider benefits that local communities can receive.

Nonetheless, there was one conclusion that was prominent: moving forward, financing FLR will likely be successful if government officials are able to cater interests of various stakeholders, especially local people whose role is central in FLR. Or, in other words, participation is key to finding sustainable financing options for future FLR initiatives.

For more about RECOFTC and FLR, please view our webpage!

The authors of this blog would like to convey gratitude to our PACT colleagues, Christy Owen and Yohann Formont, for their valuable inputs and reflections of the event and blog.